The Irish government claims that the favourable terms are worth it to ensure Ireland’s energy security, but there is no necessity for Shell to sell the gas to Irish consumers.

These are the economic realities.

Shell are not obliged to hire any Irish staff, or base support vessels in Ireland, Irish job creation prospects will be based in places like Aberdeen.

If Shell do sell back our own resources, we will be paying the full market price for them, the same price we currently pay for gas from the North Sea or further afield.

Shell can choose to pump oil or gas directly onto tankers and ship it to the highest bidder. The Irish Republic will be competing with China and the UK for its own resources.

The same will apply to any future discoveries, such as the Dooish project off the coast of Donegal on which Shell is willing to spend more than €100 million – on the basis that it can reap enormous profits by selling it back to us (the people who are its rightful owners in the first place).

The vast majority of countries demand that multinational oil and gas companies pay the state proportionately twice the amount that the Irish government is extracting from the Shell-led consortium that is exploiting the Corrib gas field.

Only Cameroon takes a lower share of the revenues from its own oil or gas resources than Ireland.

Ghana, for example, insists that the state-owned Ghanaian National Petroleum Corporation has a 10 per cent ownership stake in any resource find and the multinationals are also liable to a 50 per cent profits tax. Our terms were described by economist and journalist Colm Rapple as “decidedly soft by international standards”.

Ireland demands no state shareholding in any resource finds, nor does it demand royalty payments.

A tax rate of only 25 per cent applies – this only applies after a company’s exploration and development costs (and the estimated costs of closing down the operation when the resources are depleted) have been recovered - This I believe is a recent ammendment introduced by Bertie Ahearn. The Corrib gas field will probably be half depleted before any tax is paid at all.

The state, through Bord Gáis, will also pay for the pipeline to link the proposed refinery at Bellanaboy to the national grid in Galway.

The Irish government has, in addition, given Shell and its associates 400 acres of state-owned forest for the laying of the pipeline to the refinery, and expropriated private property through compulsory purchase orders.

The state also provides security, policing Glengad on behalf of Shell the Garda overtime bill alone is approx. €14m, not to mention the deployment and use of Naval Service assets

Under the 1975 Irish government strategy for energy extraction, the state would have held a 50 per cent shareholding in any oil or gas discovery, and the extracting company would have had to pay royalties of at least 8 per cent as well as tax at a rate of 50 per cent. Those terms were progressively relaxed during the 1980s and 1990s most notably under the tenure of Ray Burke as Energy Minister.

Lets not forget Mr Burke was convicted and imprisioned for corruption in public office. This is important for the case studies looked at later.

An estimate in June 2007 put the value of Corrib gas at €14 billion - this is conservative. As gas prices have fallen somewhat since 2007, it may be that the total value is now less than that, but credible estimates suggest that the Corrib and other sites currently being explored could, taken together, yield some €50 billion in oil and gas revenues.

If the Irish government were to take a 10 per cent stake in these discoveries as Ghana does then the Irish exchequer would stand to gain €5 billion. Taking a 10 per cent stake in the Corrib gas field alone should certainly gain the exchequer at least €1 billion.

Investing funds that would arise from a 10 per cent stake in the Corrib field alone would generate a revenue stream as is done in Norway.

Reclaiming even a portion of the revenues that are rightfully ours reduces the need for the severe expenditure cut-backs now occurring and would allow the stimulation of the economy to relieve the impact of the recession and boost employment.

As for investment costs - NAMA will cost an estimated €88 bn, Doolish development will cost about €100m

The process of reclaiming oil and gas revenues from multi-nationals for the state, is exactly what other governments are doing, and case studies are included.

A recent wave of resource nationalism has seen governments around the world take back control of natural resources which were previously in the hands of foreign companies. The following case studies show how this has occurred in just three countries: Bolivia, Russia and Venezuela.

In none of the cases did the affected companies (including Shell) walk away from their investments, despite their dissatisfaction with the new regimes, because the profits are too large.

Its very simple, the people who negotiated the current contract were corrupt to the core, Ray Burke was convicted for corruption.

The only thing that stops a renegotiation of the current situation is the lack of political courage, or perhaps it is something else?

The current situation is untenable, but the media have successfully portrayed objecters as the lunatic fringe.

MEDIA CONTROL

What was particularly distasteful was the TV3 'investigative' documentary, an absolute propaganda drive by Shell. It was a joke, with snide remarks and innuendo.

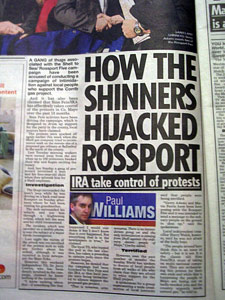

We need to look at the journalist, Paul Williams.

The reporting had bias, three years before the documentary Williams had made up his mind.

Paul Williams is the son of a Garda. The Gardai have much brutality and violence to answer for in Corrib.

Williams is a crime correspondent, dependent on the Gardai for information and without whose cooperation he would be unable to function as a reporter.

He has to keep them sweet and boy, does he keep them sweet. The violent 'confronting' has all been done by the Garda - not by the residents of the area.

He has shown himself to be virulently biased in favour of Shell on several occasions. RTE's reporting of the issue has been a national disgrace and an outrageous affront to journalism since 2006 - as their recent coverage of the violent assault on Willie Corduff makes evident.

It is worth noting Mr Williams has, since his reporting started, been a corporate guest of Shell at the 2007 England Rugby match at Croke Park, part of what Shell told the Phoenix was their “stakeholder engagement list.”

Shell spends huge amount of money on PR, in 1998 “Shell spent US$30 million on contracts with PR company Fishburn & Hedges alone.”

The article “Irish Times Shell PR” in the May 22 issue of the Phoenix looks at how in Ireland Shell have successfully changed the line of the Irish Times over the last two years to the point where now the Irish Times now frequently send their crime correspondent to cover protests in Erris.

The Irish Times is not unique in this respect, media outlet after media outlet considers it suitable to send crime correspondents to cover the protests who, like Williams, depend on developing and maintaining positive relations with the Gardaí to continue to get news stories.

If they want to continue to get the scoops their jobs depend on they are not in a position to bite the hand that feeds them such stories.

Such is the success of Shell’s PR machine that when Colm Rapple, a guest on RTE’s ‘Marian Finucane’ show managed to slip in a mention of the Bolivian story that Cathal McCarthyattacked him in The Independent, threatening that “it might be unwise of RTE to allow anyone to suggest outlandish and ruinous speculative motives to what was, at the very least, the violent killing of an Irish citizen in the most dubious circumstances of which it is possible to conceive.”

The Independent is controlled by Tony O’Reilly’s, pre-crash billionaire who coincidentally holds a “40% stake in Providence Resources Plc, the Irish based oil and gas exploration and development company.”

He controls the The Independent group, the Evening Herald, Irish Independent, Sunday Independent, Sunday World and the Irish Daily Star, as well as 14 regional titles and two free newspapers as well as a 98% stake in the Sunday Tribune.

None of these titles have named names on the Shell – IRMS – Bolivia story although most if not all of these titles have been happy enough to throw all manner of weird and wonderful accusations at the locals who oppose the Shell pipeline and their supporters.

Even if your not a journalist currently working for an Independent title you’d want to be careful of pissing off the family who own a 40% state in an Irish oil and gas exploration company as you may well be looking for a job at one of those titles in the future.

And its not like what it left of the Irish media has been a whole lot better with the honorable exception of The Phoenix and the Irish Examiner, both of which are sadly rather small circulation niche titles.

Another consequence of Shell’s highly successful PR offensive is the routine appearance of articles in the media that seek to portray the locals and their supporters as subversives.

Sometimes this can be quite farcical, for example the Phoenix points to the Irish Time’s Peter Murtagh getting away with publishing an article in March where he links the struggle to “ ‘notorious INLA murderer’ Dominic McGlinchy” on the grounds that “his son supports the protests.”

While there have been acres of coverage in the media on that sort of basis the facts revealed in the aftermath of the killing of Dwyer have received scant coverage.

NATIONALISATION AND LEGALITY

Other than SF, no other party in the Dail has the balls to address this issue full on, corporate threats keep them in line.

We are fully within legal rights to renegotiate the Shell deal, and should do so

A recent wave of resource nationalism has seen governments around the world take back control of natural resources which were previously in the hands of foreign companies.

The following case studies show how this has occurred in just three countries: Bolivia, Russia and Venezuela.

In none of the cases did the affected companies (including Shell) walk away from their investments, despite their dissatisfaction with the new regimes, because the profits are too large.

Bolivia

In Bolivia the nationalisation was initiated during the 2003 ‘gas war’ in which thousands of citizens took to the streets to demand the state take back control of the nation’s gas reserves.

The country came to a standstill and the army was dispatched to clear the streets, leaving 60 unarmed protestors dead.

General outrage at the massacre of civilians forced President Gonzalo Sanchez de Losada out of office.

His successor, President Carlos Mesa, held a referendum which would allow citizens to express an opinion on the ownership and exploitation of the country’s natural resources.

Citizens voted in a referendum to take back control of the states national resources.

The Mesa administration dragged its feet on the issue of enacting enabling legislation, sparking further protests in 2005 which forced Mesa out of office.

It is worth noting that when Eamon O Cuiv was asked about the possibility of a referendum he answered, "We dont need to - the Government owns the resources" - I thought they belonged to the Nation??

It is worth noting that when Eamon O Cuiv was asked about the possibility of a referendum he answered, "We dont need to - the Government owns the resources" - I thought they belonged to the Nation??Eventually President Morales issued the decree of nationalization.

International commentators expressed displeasure, complained the EU Commission but there was no international backlash and the Bolivian government proceeded cautiously, paying out compensation and rewarding compliant companies with fresh investment opportunities.

Foreign companies, including Shell, agreed to the new terms.

Russia

Vladimir Putin tackled the issue from a different angle, picking out breaches of regulations - including corruption legislation - to halt and review operations and ultimately retake majority ownership of key fields.

In December 2006 Russia’s Ministry of Natural Resources published a 600-page dossier – prepared by environmental watchdog Rosprirodnadzor (RPN) – which listed alleged environmental violations by Shell and its project partners at the giant Sakhalin oil and gas field.

More significantly, the Russian government announced that in the light of Shell’s improper activities, the terms of the deal, signed ten years previously, would have to be renegotiated.

The report gave legal and political cover to what was effectively a heave against Shell in the name of energy security.

Shell took the blow well, realizing that even a lesser stake in a large field is better than no stake at all.

Gazprom agreed to pay $7.5 billion for a 50 per cent-plus-one-share stake, leaving Shell with a 27.5 per cent stake, down from 55 per cent. Shell’s chief executive, Jeroen van der Veer, described talks with Gazprom executives as “constructive” but the Russians were more direct, saying that Shell had become cooperative after the company was threatened with having its operating licence withdrawn.

The Russian government also moved on BP to surrender control over a Siberian field, again citing environmental violations, similar to what we have seen in Mayo.

With the multiple violations of planning and environmental laws by Shell - in addition to the involvement of Ray Burke, Bertie Ahearn and Frank Fahy in the current deal it is a possible model.

Venezuela

Standard Oil and Shell had seized control of 85 per cent of the industry.

Opposition to foreign control over oil resources prompted nationalization in 1976 but little changed as foreign companies enjoyed decisive influence over policy at state energy giant PDVSA.

In 1998 Hugo Chavez was elected President. The price of oil soon tripled in value and in 2001 Chavez approved the Hydrocarbons Law which reclaimed state control over PDVSA.

In March 2008 Chavez had announced a windfall tax on ‘extraordinary oil profits’ to help expand the provision of healthcare services (a similar law has been enacted in the UK I believe)

Increased health provision raised the number of doctors, rising from 20 to 60 per 1,000 people.

In May 2007 the Chavez administration nationalized the Orinoco River Belt oil reserves, insisting that the state hold a 60 per cent stake in the region’s oil projects.

Italian energy company ENI accepted compensation in return for a lesser stake in the area but Exxon rejected an offer based on the value of the company’s stake at the time of nationalization.

Exxon demanded it be given projected profits from the ‘Cerro Negro’ project, which company lawyers estimated at $5 billion.

A London Court ruled in favour of Venezuela and Exxon was ordered to pay PDVSA’s legal fees.

======

Lessons for Ireland

Could it happen here? Yes, it could, and a variety of legal reasons can be advanced as to why the terms of the Corrib gas deal should be renegotiated so as to ensure that a fairer share of the resources accrue to their rightful owners – the Irish people.

These reasons include breaches of environmental and planning law and a possible investigation into corruption by officials

HUMAN RIGHTS ABUSE

Namely the right to protest and the right to a private family life (art 8 sec 1 & art 11 ECHR)- European convention of Human Rights) perpetrated by Shell and its partners.

The well founded suspicion that Shell’s private security force is engaged in such illegal practices should be sufficient reason to halt work at the site pending an independent investigation.

Shell’s private security agents – Integrated Risk Management Systems (IRMS) – have engaged in surveillance operations against local people, aledgedly filming children as they undress on the beach at Glengad and aiming cameras into the kitchen of a nearby home as well as assault.

These security guards previously included Michael Dwyer, the Irishman shot dead by police in Bolivia in April. Dwyer worked for Shell at Glengad with a Hungarian colleague who invited him to visit Bolivia and connected him with Eduardo Rozsa Flores, a mercenary in Croatia with links to fascist groups.

Pseudo Paramilitary Crests issued by Shell Security staff

It is still not known exactly what happened when armed troops moved to arrest the men, but the operation left three of the five men dead, including Dwyer and Flores.

On any of these grounds, an Irish government could call a halt to the project and launch an independent review to reconsider both the wider issue of ownership of natural resources and the operation of this particular project.

ENVIRONMENTAL ABUSE

The damage is ongoing. For example, in 2007 Shell engaged in unauthorised drilling on a protected habitat in north Mayo, breaching the European Communities (Natural Habitats) Regulations 1997 which obliges any such work in a Special Area of Conservation (SAC) to be authorised in writing by the Environment Ministry.

Also, in 2007 concerned locals occupied the proposed refinery site at Bellanaboy due to the apparent contamination of local water supplies when a brown-coloured liquid seeped out of the site.

Local streams feed into Carrowmore Lake, the source of drinking water for thousands of homes in the Erris area.

Shell E&P Ireland, the subsidiary established to operate the Erris project, admitted a leak had occurred.

More recently, Shell has undertaken work at the landfall site at Glengad without the required notices of consent.

AN wants a full review of environmental, legal and economic dimensions.

The project should only be allowed resume on the following bases:

1. Local people should not be forced to live with a high-pressure pipeline carrying unrefined gas through their community – the gas should be refined offshore or at a location acceptable to the local community.

2. The Irish state must receive a substantially larger share of the revenues accruing from this project; the evidence from other countries proves that such renegotiated terms would not cause Shell or any other firm to discontinue the project or deter investment in the future.

3. Revenues gathered from a renegotiated contract should be used to develop a national investment portfolio to generate a manageable revenue stream - much in the same fashion as pension funds. AN should be very wary of allowing any future Government direct access to the funds, as FF proved, they can be squandered very quickly with no long term benefit.

LEGAL CHALENGES

Legally it is already possible to negate any existing contract rapidly within current legislation, there is no need to apply a new law retrospectivly.

Evidence from other countries proves that such renegotiated terms would not cause Shell or any other firm to discontinue the project or deter investment in the future.

The licensing terms for offshore oil and gas exploration, development and production, available on the website of the Department of Communications, Energy and Natural Resources website, state that

“The Minister may, for such period as the Minister deems necessary, require that specified exploration, exploitation, production or processing activities should cease… subject to conditions which the Minister may specify, in any case where the Minister is satisfied that it is desirable to do so in order to reduce the risk of injury to the person, waste of petroleum or damage to property or the environment. No claim for compensation may be made against the Minister on foot of any such requirement”.

This clause can be invoked to serve the needs of the Irish state and people.

Otherwise we are simply giving away our gas with little benefit to the State.

Free Blog Counter